What Is a Loan (Qarza)?

A loan or Qarza is a financial agreement whereby a lender advances money to a borrower with the anticipation of receiving such money back with the interest. Individuals use loans to handle emergencies, launch businesses, or purchase essential products.

Types of Loans

Personal Loans

Personal loans are versatile and may be used to pay medical bills, travel, and home repairs or day to day expenses. They are typically accompanied by a fixed monthly payment.

Business Loans

Companies also avail of these loans to grow or buy equipment or to build stock. The credit history is good and can be used to secure better loan terms.

Home Loans

The home loans are long term loans which assist people to acquire or construct homes. The interest on them is usually lower as compared to other types of loans.

Car Loans

Car loans assist buyers to buy new or second-hand cars. The repayment is completed in monthly installments.

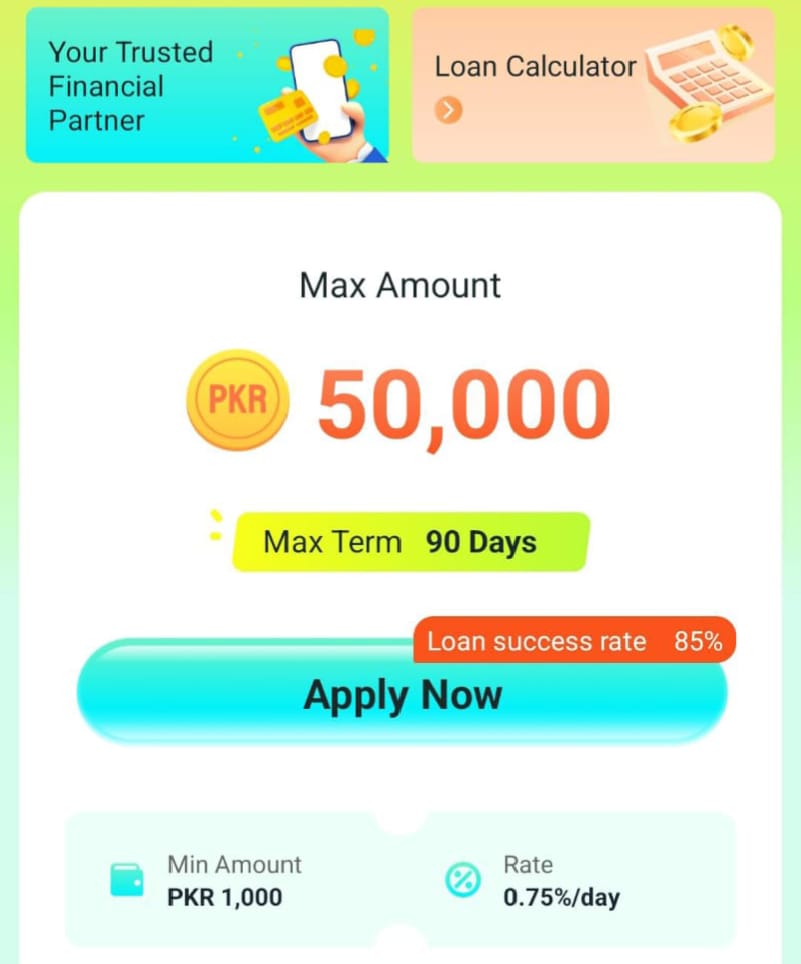

Apply Now!

Emergency Loans

Emergency loans refer to hasty loans that are used on immediate items. They might be expensive in terms of interest rates, yet they are fast.

How Does a Loan Work?

Loan Application

The borrower gives simple paperwork such as identification papers, bank statements, and evidence of revenue.

Approval Process

The lender will screen the credit rating, financial stability and solvency of the applicant.

Repayment

The borrowers pay the loan in monthly payments. Failure to make payments may result in punishment and reduced credit rating.

Benefits of Taking a Loan

Financial Support

Banks offer loans as a relief to insufficient savings.

Easy Installments

The borrowers have the chance of paying the sum at a slow pace in form of manageable monthly payments.

Credit Score Improvement

The timely repayment of loans makes you financially credible.

Risks of Taking a Loan

High Interest Rates

Other lenders have high interest thereby raising the amount of repayment.

Debt Trap

Excessive borrowing or defaulting on debts may result in financial difficulties.

Hidden Charges

The cost of borrowing may be increased by processing charges and fines.

Tips Before Taking a Loan

Check Your Budget

Borrow only to the level that you can comfortably repay.

Compare Interest Rates

Compare various lenders and then make the final decision.

Read Terms & Conditions

Know the rules, charges and penalties of repayments and read before signing.

Conclusion

Loans (Qarza) are useful financial instruments when applied in a responsible manner. They may assist with the crisis needs, business expansions and significant purchases. Nonetheless, it is quite essential to be aware of interest rates, loan agreement and conditions of repaying it. Wise borrowing and spending can help you to lower your stress levels.